Anyone driving an electric car through Germany still needs several charging cards, RFID chips or apps to reach their destination safely and conveniently in terms of charging.

There exists a high three-digit number of charging service providers in Germany. The field of providers is large: in addition to national energy suppliers and municipal utilities, independent roaming services, retailers, charge point operators (CPOs), but also car manufacturers and others, such as the mineral oil industry and the ADAC, are on the market with offers.

At least three Charging Cards, RFID Chips or Charging Apps

For four years, UScale has been asking electric car drivers which charging services they use, which one they prefer and why. In the summer of 2022, we again surveyed over 1,800 people who regularly charge their cars in public. The respondents drive their electric car for an average of two years. So they have a lot of experience with public charging and know what they are talking about.

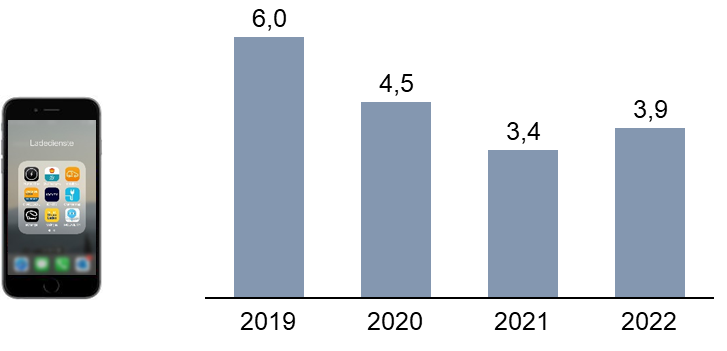

The number of charging services that respondents use actively, i.e. at least occasionally, has fallen significantly in recent years. Now it is rising slightly again for the first time, but remains below 4.

Electric car drivers often do not use all services equally. Rather, the respondents have a favourite that they prefer to use. The other services are only used in certain situations where they bring specific advantages.

EnBW is by far the Market Leader in Charging Services

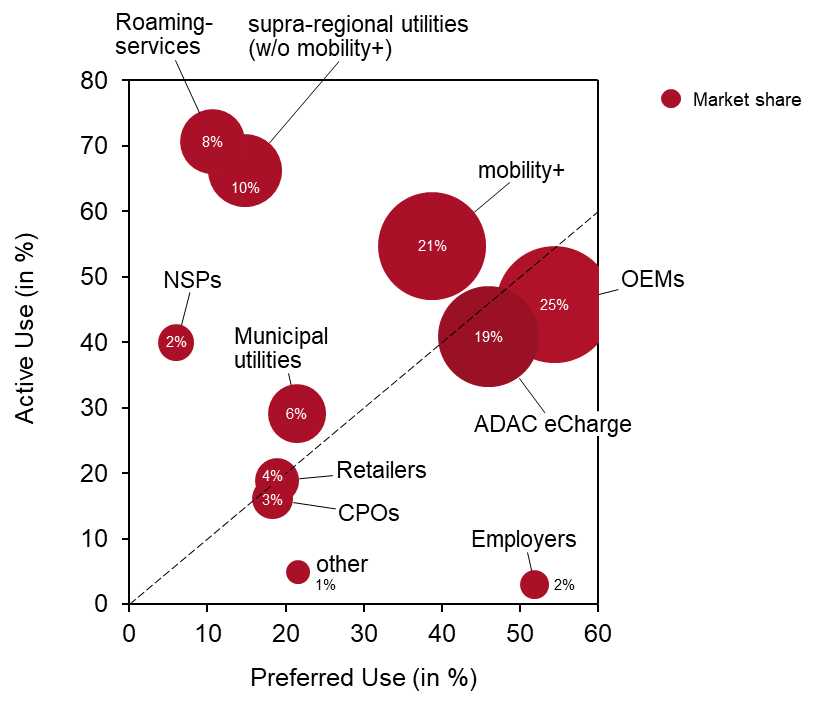

Two factors were decisive for our analysis: Firstly, drivers must have a charging offer “on their radar”, i.e. they must have concluded a contract, have downloaded the service on their smartphone or be registered (active use). Since charging business models are based on usage-based business models, the actual and preferred use of the services is decisive for providers (Preferred Use). We have calculated the market share from the proportion of how often a provider is preferably used. This value roughly represents the status quo and makes it possible to track changes over the years.

EnBW holds on to first place with mobility+ and its sister offer ADAC eCharge. Together, they can once again expand their market share to now around 40%.

The group of car manufacturers follows in second place with a market share of 25%. They, too, have been able to make gains compared to last year. It is striking that Tesla no longer plays a special role: Tesla owners do not use the brand’s own charging service more often than the average owner of many other brands.

In addition to EnBW’s offerings, the charging services of all the other supra-regional energy suppliers are clearly falling behind. Together, they have a market share of only 10%. The sum of all municipal utilities comes to a market share of 6%.

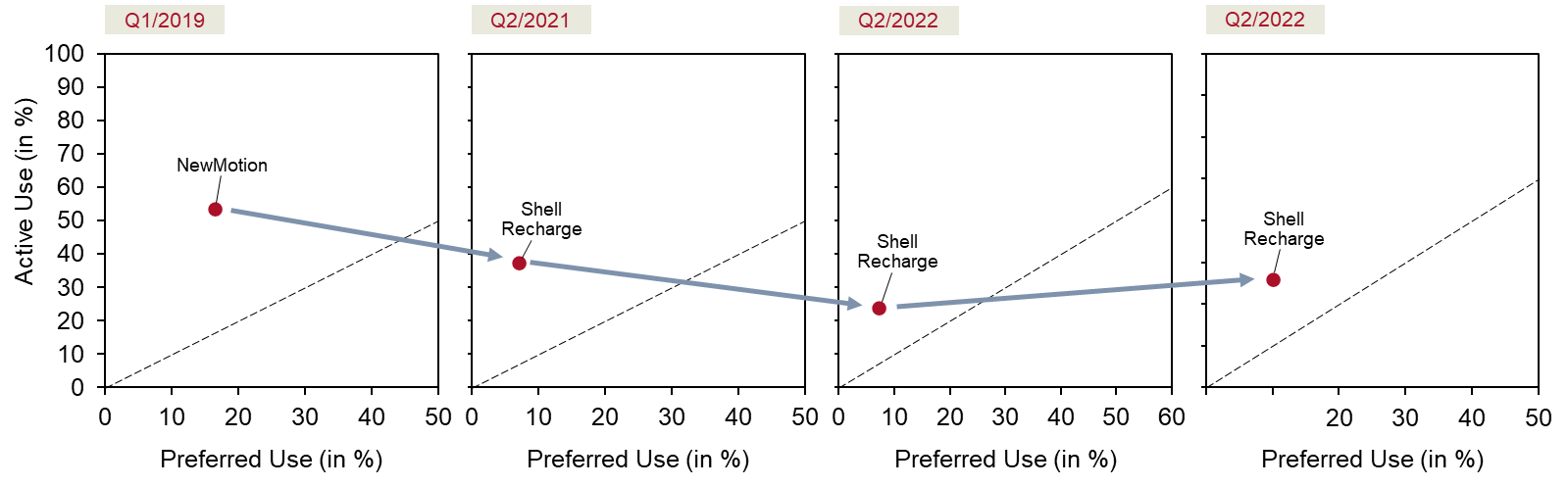

The share of independent roaming providers such as Shell Recharge, Plugsurfing, Chargemap, etc. has further decreased to currently 8%. As a “universal tool” in the provider range, they played an important role in the early days of electromobility. With the improvement of the other offers, they are losing importance.

The so-called navigation service providers share the same fate. These are mostly directories that are based on the freely available data from Going Electric, but do not offer a payment option. They now only have a 2% market share.

For the first time, two provider groups appear in our analysis that have not played a relevant role so far. These are, on the one hand, the retailers, some of whom commission utilities with the operation, but also act as operators themselves. They have a market share of around 4%. With a 3% market share, they are followed by charge point operators (CPOs), who bind customers directly to themselves with their own charging contracts, i.e. without the diversions via an eMobility Service Provider (eMSP).

Employers who tie their employees with company cars to charging contracts of the acceptance networks of the mineral oil companies have a market share of 2%.

The Other 1% mainly includes flatrate providers such as elvah.

Significant Changes in the Market for Charging Services in recent years

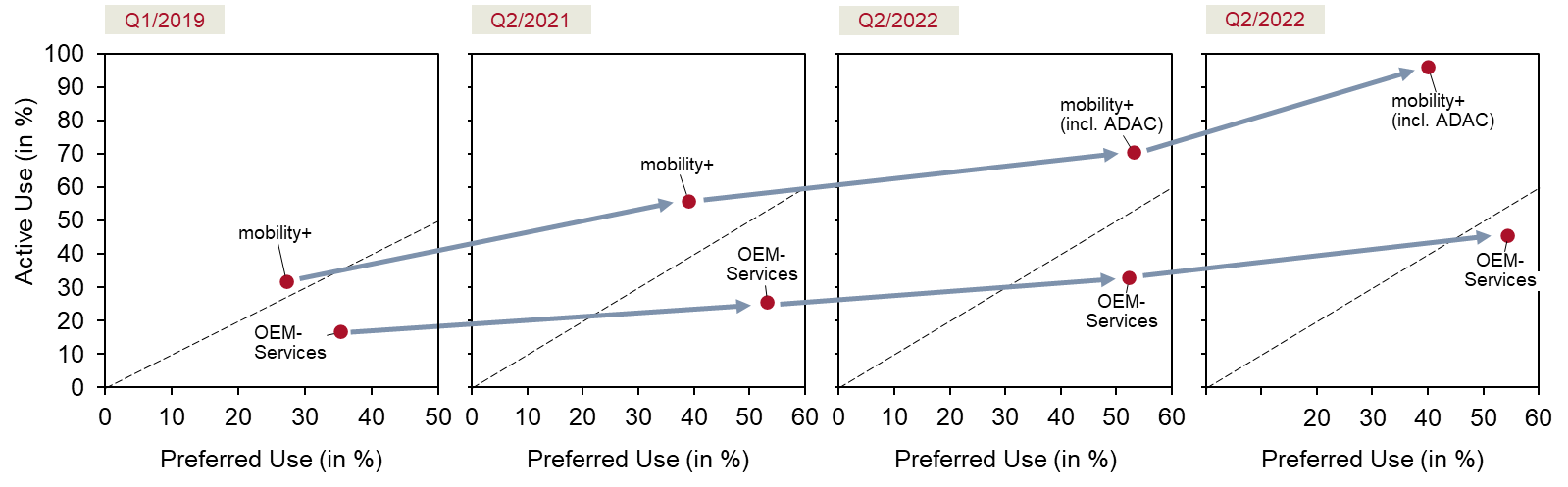

There have been significant shifts in the last four years. The mobility+ offer is convincing on the performance side and in terms of price. Through the cooperation with ADAC, EnBW has been able to achieve additional reach and also appeal to non-users of EnBW housing electricity with a favourable tariff. As a result, there are now only a few EV drivers who do not use EnBW’s offers. However, the share of preferred users did not keep pace with the increased share of active users.

OEM charging services also made significant gains. While the market was still almost entirely dominated by Tesla in 2019, many car manufacturers now offer branded charging services. The use of the brand-owned service varies greatly from brand to brand. It is noticeable that owners no longer prefer to use Tesla’s own charging service more often than the average of many other brands.

The development of the independent roaming providers is remarkable. After two years of high losses, market shares are slowly stabilising. As the largest independent roaming provider, Shell Recharge can even slightly increase its market share.

In which direction will the market develop in the next few years?

Many experts are of the opinion that charging electricity is a classic commodity, i.e. a standardised product without significant differences in performance, where price is the deciding factor in the end. Our customer studies show that price is very important, but not the only deciding factor. So it is worth taking a closer look.

Customer studies look into the past, but show trends. If you know the causes of these trends, you can look into the future. In addition, there are influences from the known legal framework conditions that change the market. These have repercussions on the offers of the service providers and the users, who are always adapting their behaviour. One example is ad hoc payment at the charging station. Payment terminals increase operators’ costs, but also allow CPOs to charge the charging customer themselves and bypass eMSPs. This creates new opportunities for CPOs, payment providers and intermediary platforms.

The current significant increase in electricity costs makes prices even more important. Electric car drivers are taking a closer look, responding to direct offers from operators and are open to variable tariffs.

Plug & Charge and Autocharge are becoming more widespread and enable providers to retain customers with more convenience.

To this end, many retailers have recognised the opportunities that charging offers offer to attract customers to shop in their shops and generate additional sales.

Where are the opportunities for service operators?

The changes in the market are helping some provider groups to strengthen their position. For others, the situation is becoming more difficult. However, our study data shows that each charging service provider offers specific strengths.

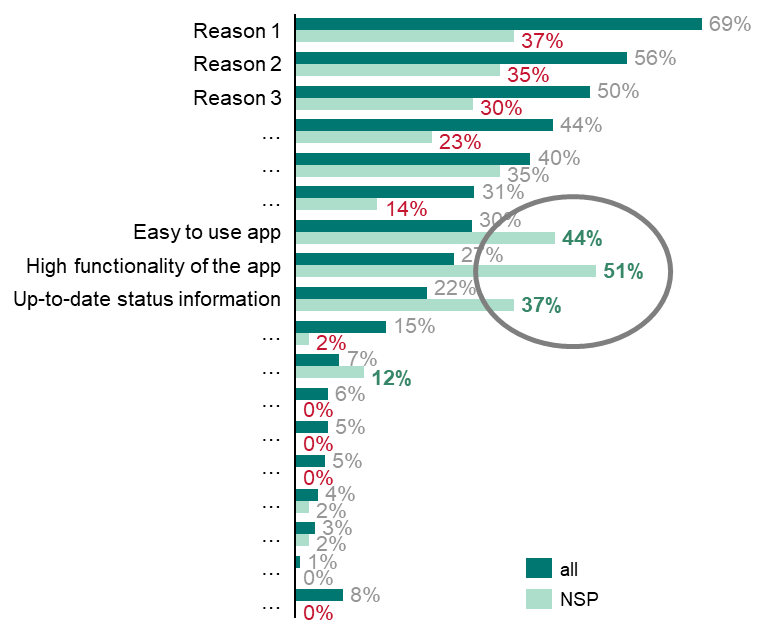

One example are the offers of the navigation service providers (NSP). As the most important reasons for use, electric car drivers cite the high functionality, the good usability and the topicality of the information (Fig. 4). In the other categories, the other provider groups offer more.

Provider groups must know and develop the specific strengths of their offer from the user’s point of view. At the same time, they must examine how they can integrate the strengths of their competitors and value-added services suitable for the target group into their own offer. In this way, they can expand their own market position.

We at UScale will continue to follow the market closely. We will definitely conduct the eMSP Benchmarking Study again next year and are already excited about the results.

Dr Axel Sprenger

More information on the eMSP benchmarking study can be found HERE.