There are probably more opinions about cars and individual models than there are drivers. The UScale EV Benchmarking Study 2022 collected and summarizes the experiences of over 3,400 EV drivers.

Who actually determines what a good car is?

The question is harder to answer than it seems. In the first place, a number of experts who share their analyses with the public come to mind. These include the TÜV Report, residual value tables from Schwacke and DAT or the many comparative tests in the relevant car magazines. Most of the key figures determined are objective and of great value to the industry and consumers.

But since cars are emotional products, more is needed than just measurements and key figures. We therefore want to let the people who drive their cars every day have their say. They know what a car can really do and which advertising promises are not only on paper, but also meet the requirements in practice.

I, the author of this article, am an engineer myself and have worked for 20 years in and with the development departments of large car manufacturers. In the past, I often heard the statement that the user’s opinion was only subjective and therefore not really usable. This view has changed significantly in the meantime. In the development departments of all car manufacturers, customer feedback is now read and analysed very carefully.

How can companies work with customer feedback?

When working with customer feedback, there are some aspects to consider. For example, customers always measure their experience with a car against their expectations. A major factor influencing expectations is the price. I expect more from a Porsche Taycan than from a Renault ZOE. So it happens that a Dacia can theoretically perform better than a Porsche.

A second important aspect is that every single opinion counts, but not every wish can be implemented. In order to objectify the many subjective individual opinions, one surveys as many drivers of a brand as possible and then works with mean values, medians and distributions. The higher the sample, the better, but for tendency statements samples around 30 are sufficient, for well-founded analyses samples of 100 per model are very good.

In our EV Benchmarking Study, we asked around 3,300 EV drivers in summer 2022 about their impressions with their electric car. Specifically, we wanted to know how they use their car and its functions, what problems they encounter, how mature they consider the concepts to be and what recommendations they have for car manufacturers and their development departments.

Satisfaction with EVs is falling, although the cars are objectively getting better

Electric cars of today are not comparable to the models that came onto the market 10 years ago. So objectively speaking, a lot has changed.

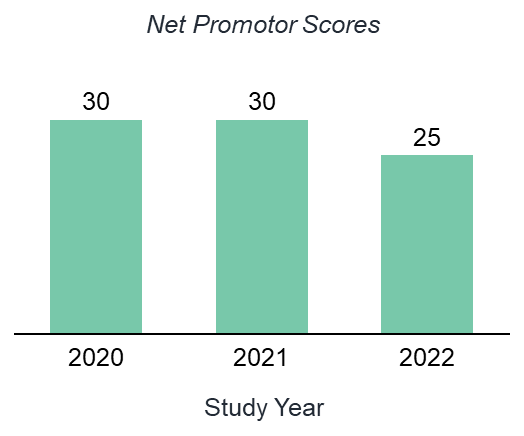

Are you familiar with the question of how likely you would be to recommend a product to a friend or colleague? Market researchers calculate the so-called Net Promoter Score (NPS) from the answers, a key figure that describes the willingness to recommend and thus the overall satisfaction with a vehicle. To our surprise, the NPS value does not reflect the technical improvement of electric cars. On the contrary: since our first measurement in 2020, the values have even fallen slightly (Fig. 1).

The reasons are obvious: as the technology improves, new customer segments are successively entering the market. The first electric car drivers, the so-called innovators, were often still adventurers who generously overlooked many technical problems. The early adopters who bought an electric car in the last two or three years are more demanding. Expectations are rising faster than the technology is improving.

Big differences between the car brands

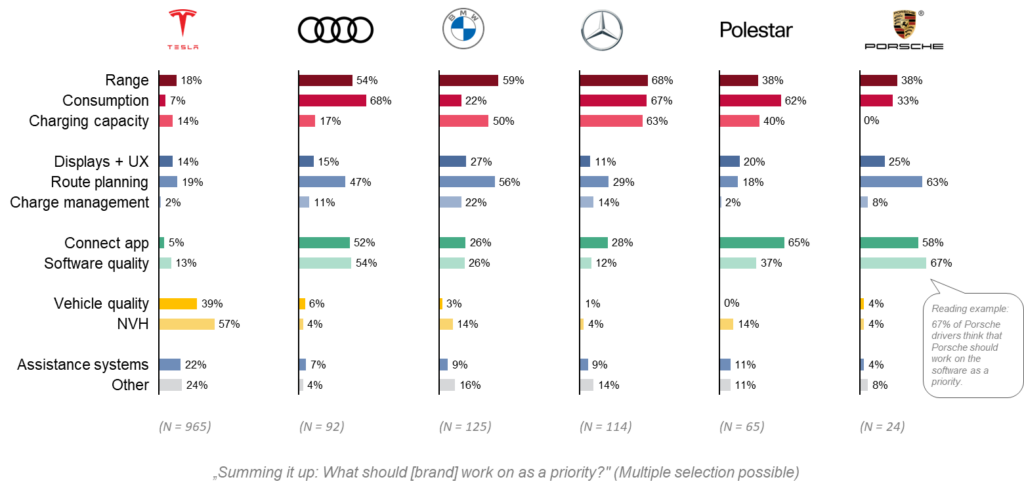

Let’s return to our opening question, namely whether Tesla is the best electric car. Measured by the Net Promoter Score (NPS), the answer is a close yes (Fig. 2). With 81 points, Tesla leads the field. Polestar follows close behind with only one point.

The values shown are average values across all models of a brand. It is therefore worth looking at the details: BMW’s new models, such as the iX4, perform significantly better than the technologically older i3. At Mercedes, the study mainly includes the EQA and EQC models. The EQE and EQS are technologically more advanced, but have not yet been surveyed here.

What was interesting for us was that the Ford Mustang Mach-E performed significantly better than VW’s ID models. The Mach-E is based on Ford’s own platform from the USA. Next year, Ford will introduce a crossover built on Volkswagen’s MEB platform.

The models from VW and Skoda already share a platform, but apparently differ so much at various points that this leads to significantly different perceptions on the part of the user. The opposite is true for the sister brands Opel and Peugeot under the Stellantis umbrella. Opel and Peugeot quite obviously share a large part of their genes, while Fiat goes its own way and performs significantly better than the two sister brands.

The poor performance of Aiways, the first Chinese manufacturer in our study with a sufficient sample, is remarkable.

A word about Nissan: The last model year of the Nissan Leaf was evaluated here. We are very excited when the Ariya makes its debut in the study next year.

What makes a good electric car?

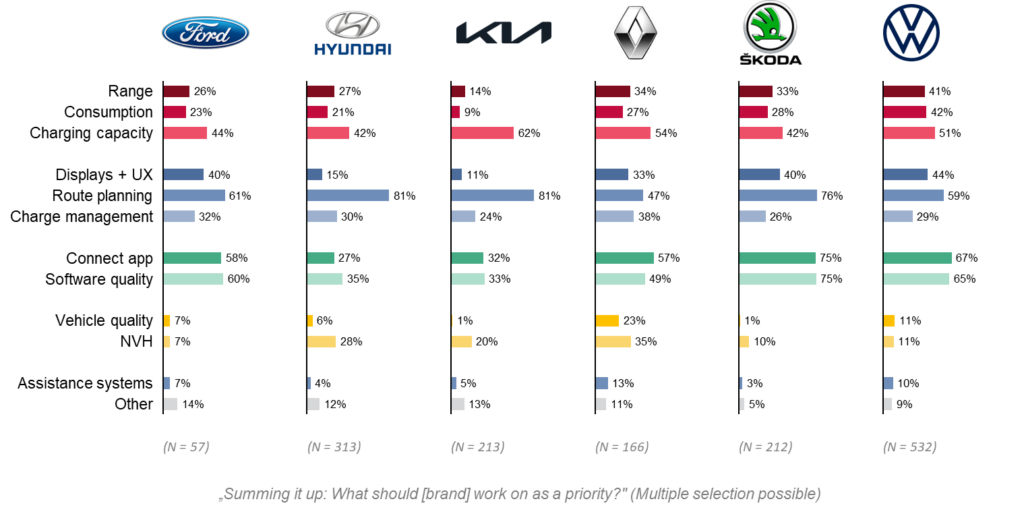

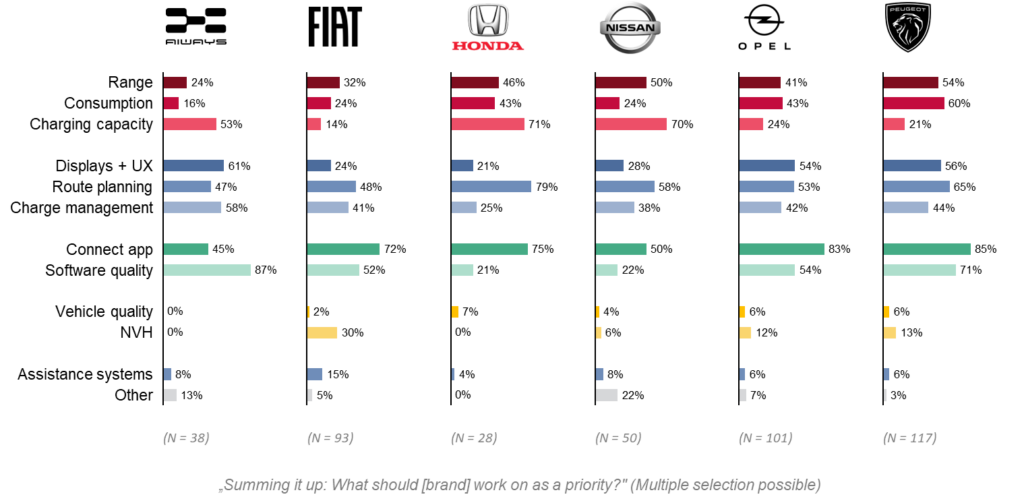

Of course, an electric car has to be convincing in all the areas where an internal combustion vehicle has to be convincing. But there are some additional functions that are added or become more important with electric driving. In terms of EV-specific aspects, the respondents see three major areas in which an electric car must score points. This is also where they see the greatest need for action across all manufacturers:

- Range, consumption and charging

- Topic area EV specific functions, such as displays, charging station search and charging

- Connectivity and Software

The fourth topic mentioned by the respondents is quality and NVH (NVH stands for noise, vibration, harshness, i.e. a part of ride comfort). Both are rather classic disciplines that are also known from the world of combustion engines. Since one brand has a particular need for action in this area, we have also included this topic.

To a large extent, the brands show very different needs for action (Fig. 3 to 5).

Tesla, the winner of our survey, still shows great need for action in the classic fields, quality and noises of all kinds. Audi and Porsche suffer from the software problems that have been widely discussed in the press. In addition, Audi has high fuel consumption, which is reflected in the range. Although Polestar is in second place in our ranking, there is clear criticism of the Connect app, which was introduced late, and the high consumption.

The data show that the sister brands Kia and Hyundai quite obviously share the same platform. Apart from the charging performance, the focus of action is very similar. Renault, one of the pioneers of electric mobility, has not yet been able to translate its many years of experience into convincing product concepts. The data from Skoda and VW also clearly show that the models are based on the same platform and therefore have similar problems. Nevertheless, Skoda scores better than VW in terms of recommendation, which is largely due to the difference in expectations.

Aiways scores well on the important EV-specific criteria of consumption and range, but has a lot of room for improvement in all other aspects. Fiat drivers find fault with the Connect app, which falls short of their expectations. The Honda E has only a short range. But what annoys users more is the low charging performance and the Connect app. The main gripe of the Nissan Leaf is the low charging power and the now uncommon CHAdeMO plug. Apart from the charging power, Opel and Peugeot show great need for action in almost all criteria that make a good electric car.

When will electric cars become better than combustion engines?

Those who have read this far know, the answer: “better” is subjective and the spread among the brands is too great for a generalisation. Nevertheless, we dare to make a comparison. The NPS values of major car brands from the combustion era are between 30 and 40 (horizont.net, hubspot.de). The values of many EV models today are already well above these values. Yes, the range remains a challenge, but electric vehicles can already do many things better than combustion engines. In the eyes of the early majority, EVs have already caught up with combustion engines and in some cases even outcompeted them.

We will repeat our EV Benchmarking Study next year and are excited to see how the development of electric cars continues!

For more information about the EV Benchmarking Study click here.

Dr Axel Sprenger