The USCALE Charging Payment Study 2026 is the first study to take an in‑depth look at EV drivers’ payment behaviour at public charging points in Germany. It shows which payment methods EV drivers actually use and where their dissatisfaction comes from.

Charging Payment Study 2026:

Why paying at charging stations is so frustrating and what providers can do about it

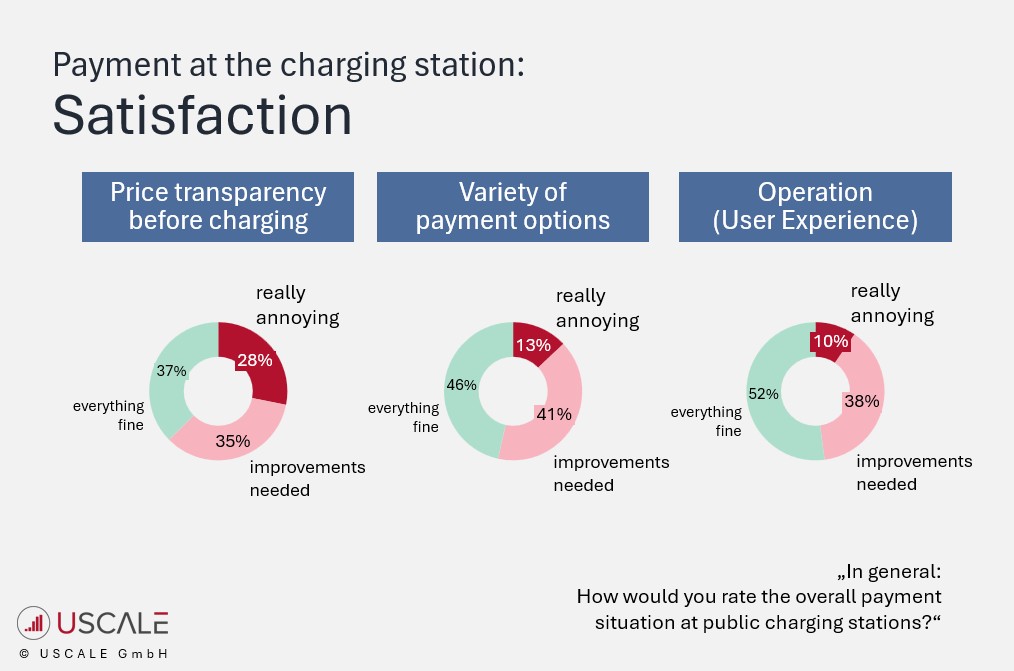

Over the past ten years, charging power, range, and infrastructure have increased significantly, and charging has become more convenient in many ways. One key issue, however, remains unresolved: the lack of transparency and convenience when paying at public charging stations.

There is no shortage of payment options or means of payment, yet dissatisfaction among EV drivers remains high.

The USCALE Charging Payment Study 2026 is the first study to take an in‑depth look at EV drivers’ payment behaviour at public charging points in Germany. It shows which payment methods EV drivers actually use and where their dissatisfaction comes from. Among other things, the study analyses

- the impact of payment methods and means of payment on the choice of charging service,

- why Plug & Charge is still used relatively rarely,

- whether drivers are willing to pay a premium for specific payment options,

- which payment strategies CPOs, OEMs and oil companies now need,

- which means of payment are particularly attractive,

- and which innovative payment solutions could help to break the deadlock.

Especially at a time when many CPOs are struggling with low utilisation, it is crucial to understand user behaviour and needs in detail.

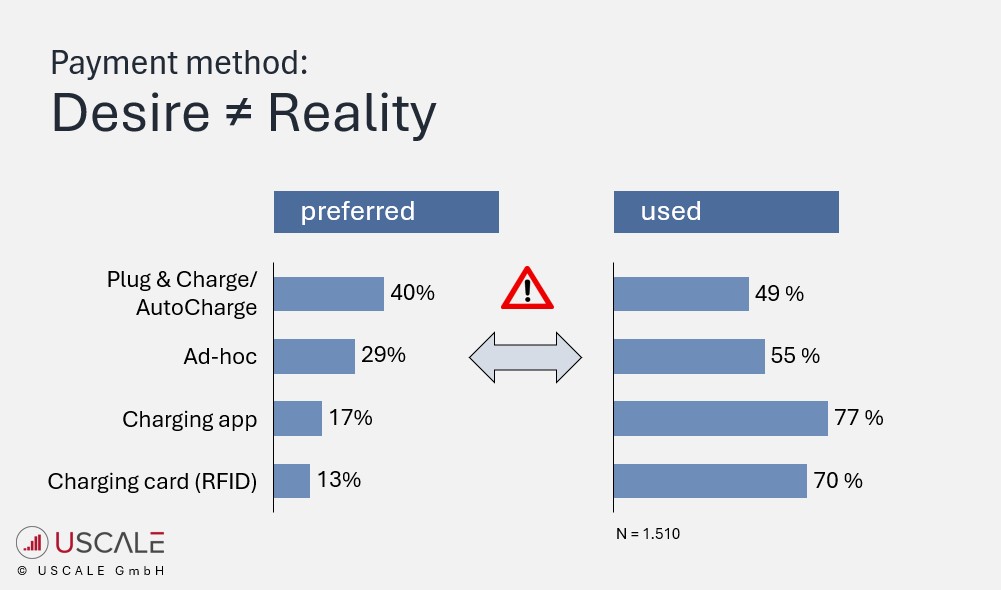

ACTUAL ≠ PREFERRED: A clear gap between usage and preferences

Given the wide range of payment options, one might assume that EV drivers are able to use their preferred payment method. The reality is different: there is a pronounced gap between what drivers would like to use and what they actually use.

Many causes of dissatisfaction

Why don’t EV drivers simply use their preferred payment method? The study identifies a broad set of reasons – from limited availability and inconsistent roll‑out to complicated processes and poor user experience.

One example is Plug & Charge/Autocharge. Even at DC charging hubs, it is not yet offered consistently. Where it is available, roaming surcharges often apply if drivers do not have a contract with the respective provider. As many vehicles can only store a single contract in the head unit, this situation occurs frequently.

Another example is direct (ad‑hoc) payment, which is now available at a growing number of charging stations. Even so, many respondents describe the user experience as cumbersome and unintuitive.

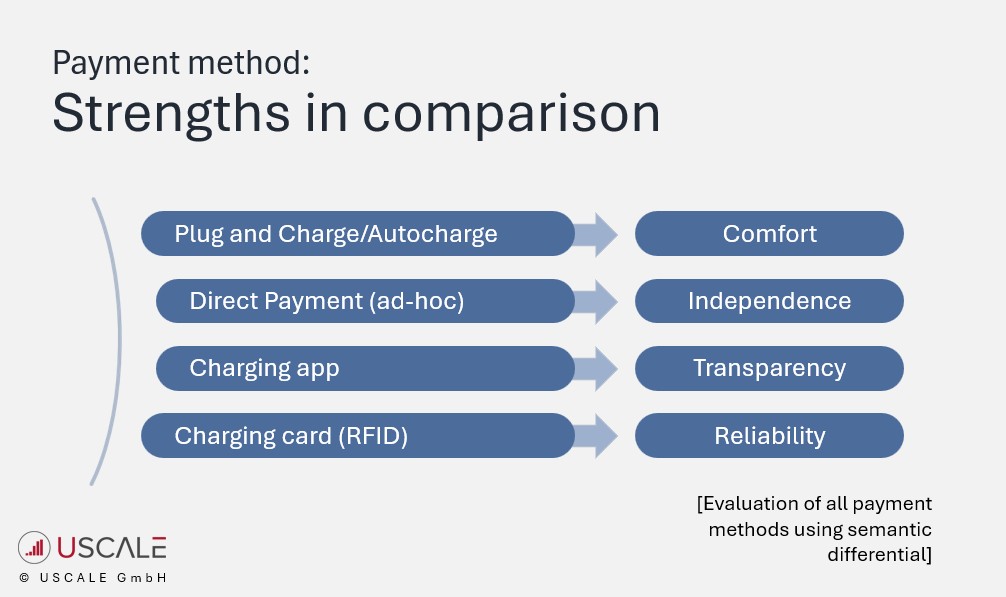

The study makes it clear: no single payment method currently meets all expectations. Instead, EV drivers see distinct pros and cons in each option – and each method addresses a different primary need.

Many payment options – no ideal solution

The strengths of one method are often the weaknesses of another. As a result, no payment method is able to fully satisfy key basic requirements such as simplicity, cost control, transparency and convenience at the same time. The growing number of options therefore does not automatically lead to higher satisfaction. On the contrary, many EV drivers believe the payment ecosystem at public charging stations is still in great need of improvement.

What does this mean for providers?

Depending on their business model, different market players are pushing different “preferred” payment methods:

- Car manufacturers want their customers to use Plug & Charge.

- Most oil companies currently focus on ad hoc payment.

- Pure CPOs would like customers to use their own charging app as the primary option

Providers therefore try to steer customers towards their preferred payment method. To succeed, they need to focus on two key levers:

- Reduce the downsides of the preferred method: simplify payment flows, improve user experience, increase transparency, limit roaming surcharges and expand PnC availability.

- Sharpen segmentation and targeting: use payment personas as a basis for campaigns and prioritise suitable payment options by location and use case.

Payment personas

The study shows that clearly distinguishable customer segments emerge based on preferred payment methods. These so‑called payment personas display specific behaviour patterns and affinities towards certain charging service providers.

For example, the ad‑hoc persona

- is more likely to belong to Gen X and live in a small town,

- is less likely to drive a premium brand, preferring VW or MG instead,

- uses Apple Pay less frequently and is less interested in loyalty schemes,

- tends to favour specific charging locations and CPOs.

What does this mean for providers?

The low utilisation of many charging stations leads to considerable competitive pressure. CPOs and other market players need to know their clients well – and tailor their offerings and marketing to the target groups they can actually reach. The study shows the correlations, and the payment personas show which target groups they reach at which locations with which payment offerings.

Not all open‑loop payment methods are the same

Even within the open‑loop segment – the ad‑hoc payment methods often referred to in the industry – there is a wide range of variants. Depending on the user type, different aspects matter most. Whether credit/debit cards, PayPal or Apple/Google Pay are accepted has a measurable impact on the choice of provider.

Innovative payment methods are attractive

To make payment easier and more convenient, providers are working on new solutions such as digital charging cards, multi‑contract functionality in the head unit or direct payment from the navigation app. From the respondents’ point of view, in short: anything that makes payment more seamless and predictable is welcome.

Conclusion

For the majority of EV drivers, the current payment experience at public charging stations is unsatisfactory. The industry will have to make substantial efforts to improve the situation. The frustration does not only affect the 4% of today’s EV drivers – the “charging jungle” is also putting off many potential adopters in the next segment who are considering switching to an EV.

Sources:

USCALE Charging Payment Study

Curious about the full results?

We support you with data, studies, and insights from our representative surveys. Contact us – we can help with our multi-client studies and ad hoc studies.