Who will buy an electric car next? And what does this mean for providers?

EV Adoption 2025: Who will buy an electric car next? And what does this mean for providers?

Electromobility is not progressing as quickly as many would like. The share of e-cars in new registrations is stagnating and expectations for the electric car buyers of tomorrow remain unfulfilled. Nevertheless, the number of EVs will increase significantly – it’s just unclear when.

The good thing: The industry has an influence on how quickly this happens. The better it addresses the next segment, the faster the ramp-up will be. To make this happen, it is worth taking a look at the data – especially the target group that will be the next to switch to an electric car.

Everett Rogers’ diffusion theory explains how innovations spread across target groups. The central idea is that the next segment only enters the market when it has the impression that the product is “ripe”. To do this, next segment shoppers wait for a positive signal from the preceding group.

What does that mean?

- Hardcore combustion drivers can be safely ignored.

- People who won’t be buying a car for another ten years anyway are not currently a relevant target group.

The decisive factor is therefore the point of view of those who consider buying an electric car next time. Who are these people? What do they expect? And what does this mean for providers who offer charging infrastructure, charging services and electric vehicles?

Providers don’t have to convince today’s customers, but tomorrow’s

USCALE regularly surveys current EV drivers but also the attitudes of those who are expected to buy an EV tomorrow.

Why is this relevant for B2B providers?

- Current drivers are multipliers. Their positive (or negative) experiences influence the decision of the next target group.

- 97% still drive a combustion engine car. They are the real growth market and the next segment is the key to this market.

Conclusion for providers: Only those who know how the next segment thinks can develop targeted products, services and communication strategies.

Who will buy an electric car next?

A look at the next target group, the electric car buyers of tomorrow

In Q3 last year, we asked around 1000 people in Germany who drive a combustion engine car whether their next car would be another combustion engine or an electric car (“If you had to buy a car now, would an electric car be an option for you?”).

Depending on the answers, we categorised them into:

- EV Convinced (“Yes, definitely.”)

- EV Doubters (“Not sure at the moment.”)

- EV Rejectors (“Wouldn’t buy an EV at the moment.”)

- EV Refusers (“An EV is out of the question for me at the moment.”)

Those who are convinced by EVs will form the next segment of future electric car buyers, the so-called early majority. The other groups will follow later. Incidentally, the proportion of EV Convinced has risen compared to 2023, while the share of EV Refusers has fallen further compared to 2023.n.

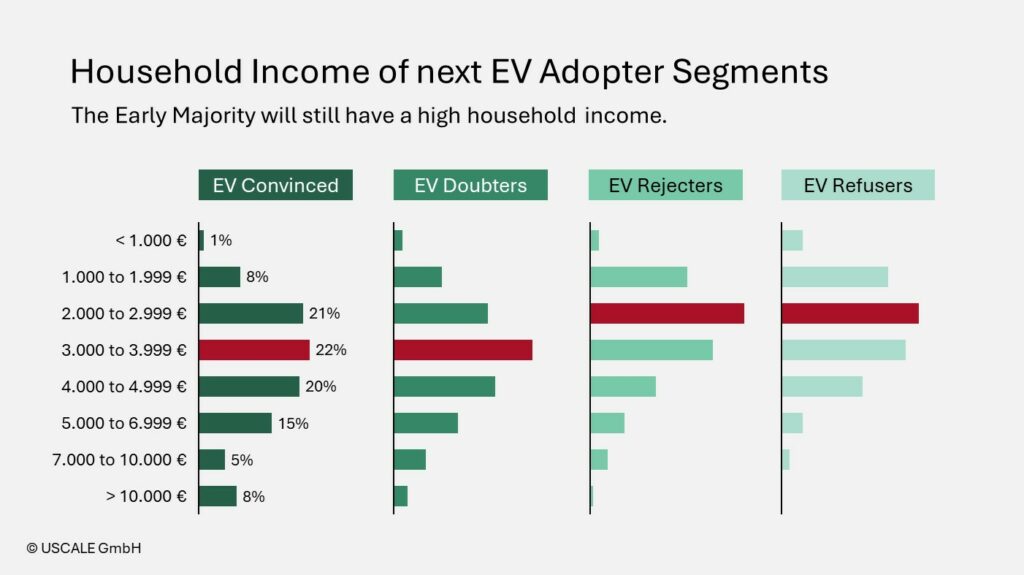

High earners or normal earners?

Electric cars were initially very expensive. Switching to an electric car was therefore easier for higher earners. More affordable models are only slowly coming onto the market. It is therefore not surprising that household income has a noticeable influence on the propensity to adopt an EV: Higher earners are more favourable towards e-cars than lower earners.

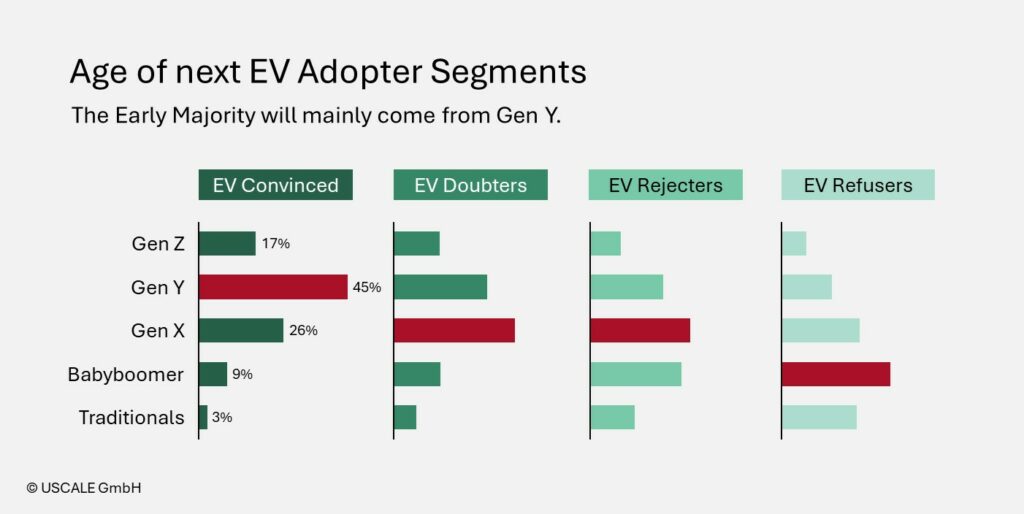

Young or old?

While tech-savvy boomers and Gen X used to dominate, Gen Y in particular is now showing strong interest. Scepticism comes mainly from older, less tech-savvy groups.

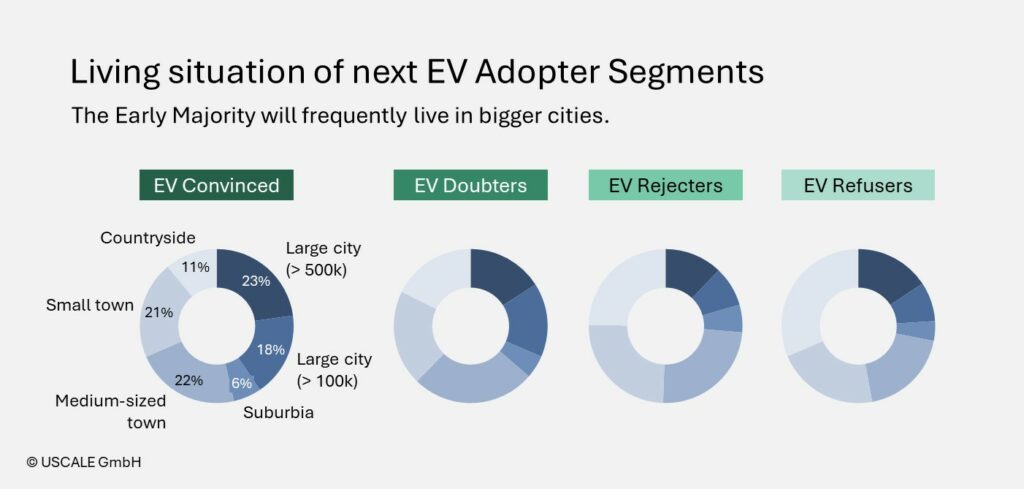

Bigger cities or rural areas?

EV pioneers lived in the countryside – with a garage, a PV system and their own wallbox. Today, city dwellers in own homes are showing increasing interest.

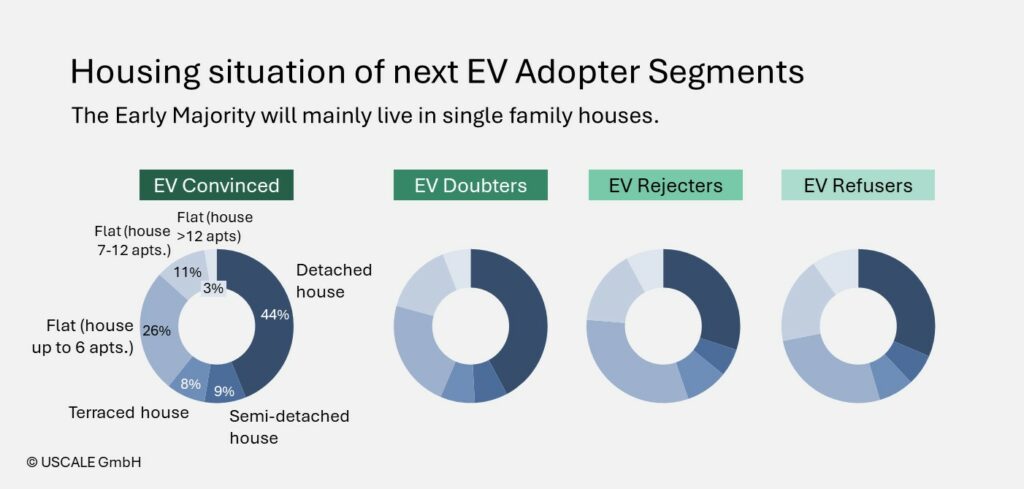

Single-family homes or apartment dwellers?

Despite the trend towards bigger cities, the next segment still lives much more frequently in single-family homes. Charging in an apartment block remains difficult for most people, meaning that switching to an EV without attractive public charging infrastructure at home is often so difficult that most people will refrain from buying an EV for the time being.

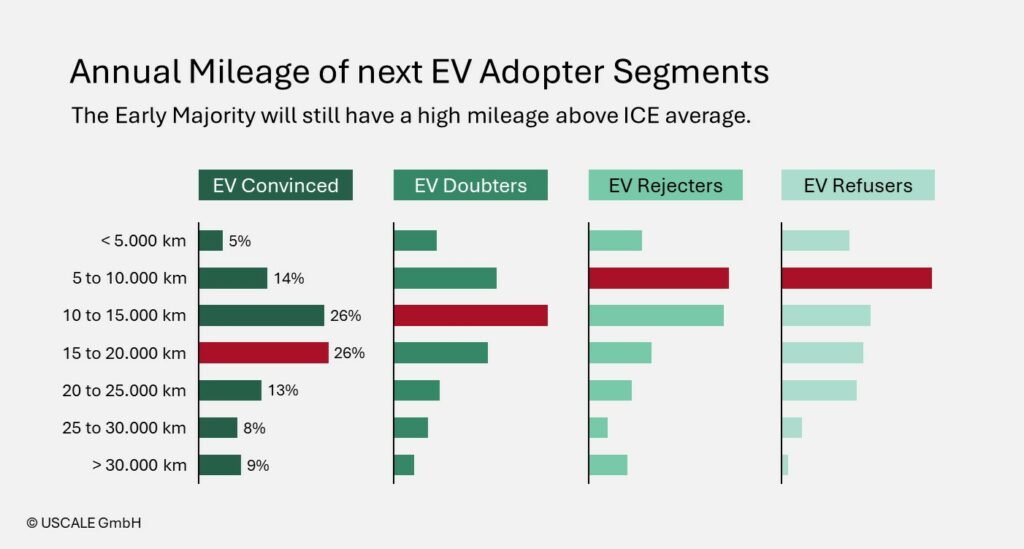

Frequent or infrequent drivers?

Now for the surprises: Current EV drivers and EV Convinced have significantly higher annual mileages than EV refuseniks. The fear of insufficient range obviously plays a subordinate role for them.

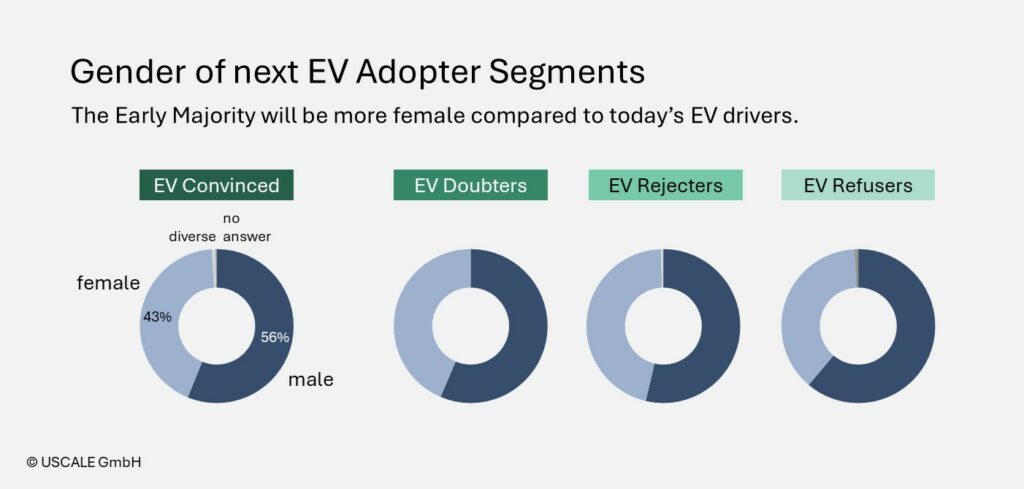

Men or women?

We were also surprised by the split between men and women. In the early days, interest in adventure and a certain readiness to suffer were part of longer electric journeys. For a long time, e-mobility was therefore primarily interesting for men. This is now changing: comfort and sustainability aspects are also increasingly attracting women.

Information behaviour, sought-after charging technology, purchase locations, expectations: Tomorrow’s electric car buyers tick differently

In addition to demographics, there are many other differences.

The next generation of customers

- seeks information via other channels,

- favours other brands and sales partners and

- has other pain points and expectations.

Vendors who only optimise for early adopters today, will miss the next segment. Now is the right time to align charging products, tariffs, digital services and communication with the usage and decision-making behaviour of the next segment. und Kommunikation auf das Nutzungs- und Entscheidungsverhalten des nächsten Segments abzustimmen.

What should B2B providers do now?

Anyone who thinks they know their customers is underestimating the dynamics. Providers of charging infrastructure, charging services and electric cars need to rethink in many areas. This includes

- Expanding target group analyses: analyse not only existing EV customers, but also those willing to switch to combustion engines

- Tailoring services and products to the early majority

- Making charging offers attractive for apartment block residents and normal earners

- Fulfilling information needs

- Fuelling relevant information channels and touchpoints

The central task: convincing tomorrow’s electric car buyers today

The transformation of mobility is taking place in waves – each with its own target groups. Those who know what makes the next segment tick have a decisive competitive advantage.

Do you want to know what the next e-car buyers think? We support you with data, studies and insights from our representative surveys. Contact us – we will be happy to help.

Please also check the overview of our charging studies!

How can we help you?

What customer insights into electric cars, charging technology or charging services are you looking for? Whatever you are looking for, we look forward to exchanging ideas.

* Mandatory fields