What is needed to make Bidirectional Charging a success?

User Acceptance of Bidirectional Charging: Breakthrough or Bust?

Some key regulatory requirements for bidirectional charging are still missing in Germany. Nonetheless, many market players are pushing ahead with the development of corresponding products and business models. So far, the focus has largely been on technical implementation. But critical questions — such as the user acceptance of bidirectional charging — remain unanswered.

Many EV drivers are eagerly awaiting the rollout of bidirectional charging beyond pilot projects. But how strong is user interest really? Which service models show promise? What are users willing to pay — and what revenue potential does this unlock? How do expectations differ across user segments and V2X use cases?

USCALE has explored these questions for the third time in a comprehensive user study. The findings offer fresh insights into the expectations, barriers, and preferences of potential users in Germany.

Here are a few selected results:

User Interest Exists — But Bidirectional Charging Won’t Sell Itself

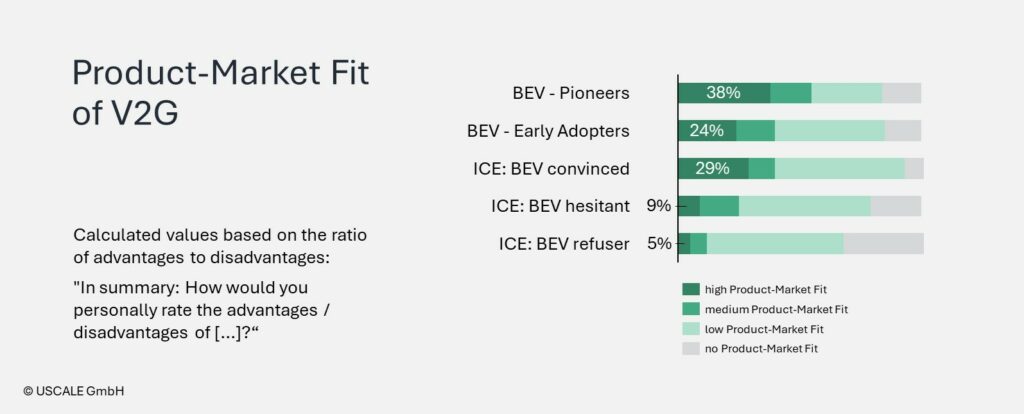

There’s clearly interest: around 30% of today’s EV drivers say they would be willing to use their vehicle as an energy storage device in Vehicle-to-Home (V2H), Vehicle-to-Grid (V2G), or Vehicle-to-Business (V2B) contexts. This highlights the potential of the technology — provided the right conditions are in place.

What does this mean for providers?

V2X presents promising opportunities for companies in the e-mobility and energy services space. Unsurprisingly, combustion engine drivers who remain skeptical of EVs are still hesitant. But as the technology proves itself, acceptance is likely to grow.

Is 30% User Acceptance of V2X a Strong Signal or Cause for Concern?

A 30% willingness to adopt bidirectional charging is certainly encouraging. Our methodology is robust, meaning this found level of interest is credible. However, it’s important to note that users assessed the product-market fit based on idealized assumptions — without full knowledge of the technical, regulatory, or financial details.

So in real-world conditions, actual uptake is likely to be lower. If we take a conservative view and cut that number in half, we’re left with roughly 15% — right at the tipping point between early adopters and the early majority. This is the crucial stage where it’s decided whether an innovation will establish itself in the mainstream market.

What does this mean for providers?

Bidirectional charging has real potential, but it won’t become mainstream on its own. Providers must take a close look at which offerings succeed and which fall flat, who adopts V2X, who churns after initial enthusiasm, and how to drive broader adoption.

From Idealism to Economics: Changing Motives for V2X

There are many good reasons to embrace bidirectional charging. For many early users, ecological values are the primary motivation. But as EVs become more mainstream, economic considerations are gaining importance. The biggest barriers? Concerns about battery degradation, lack of trust in the technology, and financial incentives that are perceived as too low.

What does this mean for providers?

Providers must tailor their messaging to different target groups. The study offers detailed guidance on how to do that effectively.

Vehicle-to-Grid: It’s All About the Payout

V2G primarily benefits grid operators and utilities. For EV drivers to actively participate, they expect meaningful compensation — significantly above standard tariffs.

What does this mean for providers?

If remuneration falls short, the business case for the user collapses. The study pinpoints the financial thresholds that matter most to different user groups.

Vehicle-to-Home: It’s All about the Cost

With V2H, users themselves benefit directly. A majority are willing to invest up to €1,500 in wallboxes and vehicle tech features to make use of V2H at home.

What does this mean for providers?

If the upfront costs are too high, adoption stalls. The study shows how different target groups define their financial limits.

Trust Is Key — Users Prefer One-Stop Solutions for V2X

At present, charging technology providers enjoy the highest levels of trust — particularly when they offer an all-in-one solution. But as new customer segments enter the EV market, preferences are shifting and new types of providers are gaining relevance.

What does this mean for providers?

Providers need to align their positioning with the expectations of specific target groups. The USPs that resonate vary by use case and perceived barriers. The study identifies the opportunities for utilities, energy service companies, car dealers, and OEMs.

What Will It Take for V2X to Take Off?

The market for bidirectional charging is still in its early stages. Many EV drivers in Germany are looking forward to its launch. Whether their expectations are met — or disappointed — depends entirely on the offerings brought to market.

Initial V2H solutions are already available. But current limitations, such as a focus on DC home charging and manufacturer-imposed caps (e.g. VW’s 10,000 kWh limit), make many offerings unattractive. Further solutions in the AC space are expected to follow. And once V2G regulations are in place, that use-case is also likely to gain momentum.

Like most innovations, V2X will scale step by step. Innovators will lead the way, followed by early adopters — who will, in turn, need to convince the early majority. Each segment will have different expectations. Providers must work their way through the market one group at a time.

About the Bidirectional Charging Study

In April 2025, a total of 1,862 EV drivers with various charging habits were surveyed. A comparison group of 506 combustion engine drivers — with different levels of interest in EVs — served as a benchmark. The study used the PAIN-GAIN framework to assess willingness to use. All respondents were based in Germany.

Want to dive deeper?

How should you design your offering? Can you overcome the barriers your users face? Which USPs will drive market adoption?

Our user study on V2X provides detailed segment profiles, usage barriers, and first indications of willingness to pay. Reach out for more information or a full overview of the study content.

We support our clients with high-quality data, representative surveys, and actionable insights — whether in the form of multi-client studies or custom research.

Jetzt Kontakt aufnehmen

Welche Customer Insights zu Elektroautos, zur Lade-Technik oder Lade-Services suchen Sie? Was auch immer Sie suchen, wir freuen uns auf den Austausch.

Error: Contact form not found.

* Pflichtfelder