For years, we have focused on the supply side of charging infrastructure. But the era of scarcity is over, and users now have a choice. (Introduction to a series of articles on European CPO markets.)

Which KPIs Help CPOs Understand Their Customers

For years, the industry has measured the CPO market almost exclusively from the supply side: the number of AC and DC charging points, installed capacity, and grid expansion.

In many countries, public charging infrastructure has now become so extensive that EV drivers have options. The question of scarcity has, for the time being, been resolved. Providers are noticing that utilization rates are falling short of expectations. For CPOs whose business cases rely on consistently high utilization and rapid growth, this is becoming a challenge.

We Complain About Low Utilization – and Neglect the Demand Side. But Now the Customer Finally Takes Center Stage

When supply is no longer the bottleneck, the key question shifts: no longer “Are there enough charging points?” but “Who charges where – and why?” The demand side moves to the forefront: customer acceptance and customer loyalty increasingly determine a CPO’s success or failure.

Key questions include:

- Who charges where? And for what reasons?

- What charging profiles and personas can be distinguished?

- Which services are actively used, and which are preferred? Why?

- How do prices, payment methods, and brand strength influence decisions in a specific charging situation?

- Which trends are shifting these patterns over time?

How Do You Measure the CPO Market?

For a provider to succeed, two things must be right:

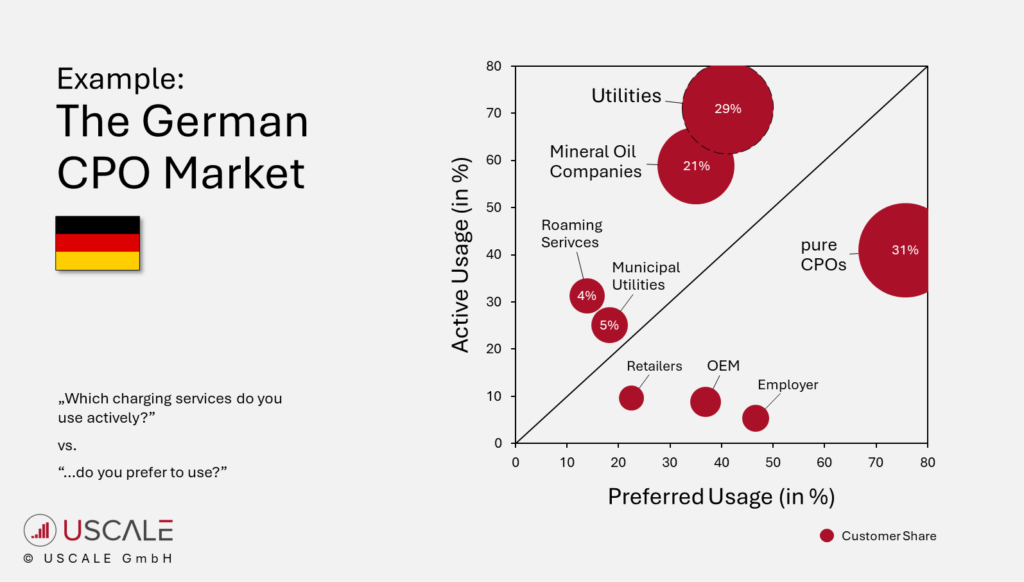

- Active Usage: EV drivers must be aware of a charging service and find it attractive enough to use it at all. In our studies, we therefore ask which charging services EV drivers actively use. The data show that in most countries, EV drivers actively use around three charging services.

- Preferred Usage: In the second step, EV drivers must find a charging service so compelling that they prefer to use it whenever and wherever they charge publicly. In our studies, we ask which of the actively used charging services EV drivers prefer – and when the others come into play.

The CPO Usage Matrix illustrates these two KPIs using the German CPO market as an example.

Our analyses show that the preferred service accounts, on average, for around two-thirds of a person’s public charging revenue. The remaining services share the final third; they are, quite literally, “on the bench.”

How Does the CPO Usage Matrix Help Providers?

The matrix shows charging market providers where they stand relative to competitors and where the main levers for improving their market position and customer loyalty lie. The chart shows aggregated values for provider groups, but the USCALE-CPO-Studies naturally break down the results by individual providers.

To increase revenues, providers must first ensure active usage. For example, a car manufacturer can offer and set up its charging service at vehicle handover. Utilities can promote their service through appropriate channels. In the second step, the offering must be compelling enough to become the preferred charging service and dethrone the current favorite.

The USCALE CPO / eMSP Charging Services Study measures both control variables and thus provides an essential foundation for all CPOs.

Market Structures Differ in Each Country

Our studies show that CPO market structures – and thus success patterns for providers – vary significantly from country to country.

Two drivers stand out:

- Regulation & Subsidies: Different political goals, funding instruments, and tender models shaped charging infrastructure in the early years of electromobility.

- First Movers: The initial demand created by regulation and subsidies motivated specific provider groups to assume the role of first movers and develop offerings.

These path dependencies are still clearly visible in every market. As a result, we see different dominance patterns in each country today.

In our upcoming blog posts on the CPO markets in Germany, France, the UK, Belgium, and the Scandinavian countries, we will show how this plays out in practice.

From Market Understanding to Customer Understanding

Market understanding is necessary. But without customer understanding, it remains incomplete. Whether you are already active in the market and want to improve your brand positioning and revenue, or you are planning to enter the market:

Successful CPOs and eMSPs:

- understand the needs and behavior of their current and desired customers,

- segment charging personas and prioritize target groups,

- actively monitor their brand positioning in the competitive environment,

- understand the reasons for churn and “latent disloyalty,” and

- derive concrete measures for marketing, business development, and product management.

What Do You Know About Your Customers?

How much do you know about your customers and their usage motives? And what do you know about the customers you would like to have but currently do not? What drives disloyalty?

The USCALE CPO/eMSP Charging Services Study answers precisely these questions across numerous European markets: from Active and Preferred Usage to brand perception and the drivers of loyalty and switching behavior.

If you would like to know where your brand stands today on the demand side – and how much untapped potential the market still holds – let’s talk.

How can we support you?

We support you with data, studies and insights from our representative surveys. Contact us – we can help with our multi-client studies and ad hoc studies.

Contact us now

What customer insights are you looking for regarding electric cars, charging technology or charging services? Whatever you are looking for, we look forward to hearing from you.

* mandatory fields