The USCALE Charging Services Study 2025 shows how competition between CPOs and eMSPs is intensifying. Providers must position themselves competitively – with their value proposition, the right target group orientation and an appropriate brand strategy.

EV Charging Services 2025: Competitive Strategies for CPOs and eMSPs

The market for public charging infrastructure is growing rapidly – even faster than the number of EVs on our roads. This creates momentum and intensifying competition among charging point operators (CPOs) and e-mobility service providers (eMSPs). Those who want to be successful in the long term must make data-based decisions and continuously review their strategy. An important basis for this is provided by the current USCALE Charging Services Study 2025, which examined the behaviour of 2,210 EV drivers in Germany in detail.

A key finding: the most important KPI for CPOs and eMSPs remains utilisation – the utilisation of charging points. This is precisely where it will be decided who will keep up in the future and who will lose market share.

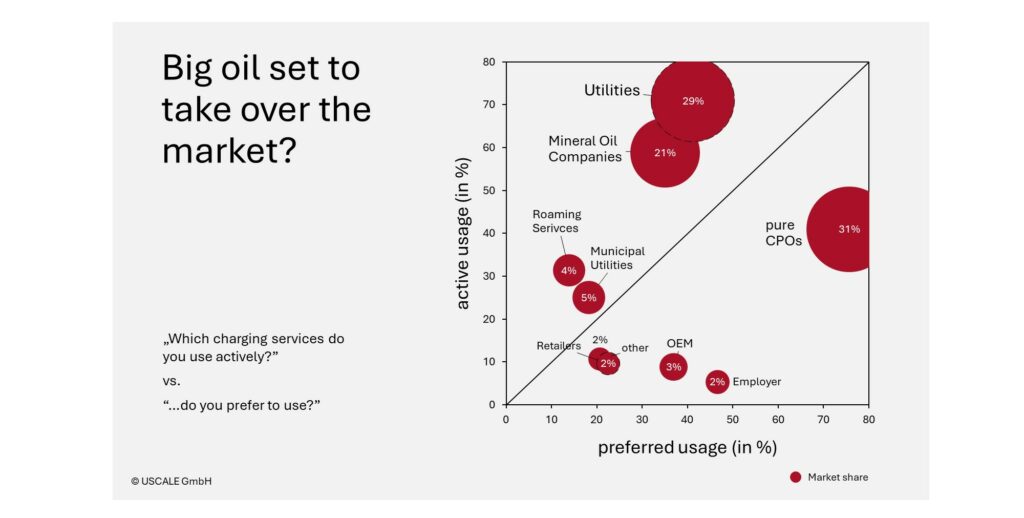

Market share in 2025: Big Oil on the rise

The industry is navigating. This is particularly evident in the market shares of the various provider groups:

- Oil companies are increasing their share of the charging market from 13 to 21 per cent – a massive increase in just one year.

- Traditional energy suppliers and pure CPOs are coming under pressure. Although they continue to dominate, they are losing ground slightly.

- Municipal utilities are also affected and are losing market share.

- Roaming providers, on the other hand, are breaking their long-standing downward trend and growing again for the first time.

- Charging stations remain attractive for EV drivers, but do not play a significant role in the provider ranking.

Particularly interesting: without Tesla drivers, the share of pure CPOs falls to 20%, while oil companies and energy suppliers gain ground.

What does this mean for providers?

The market environment is constantly changing. CPOs and eMSPs must keep track of the changes and keep a close eye on their own position and that of their competitors.

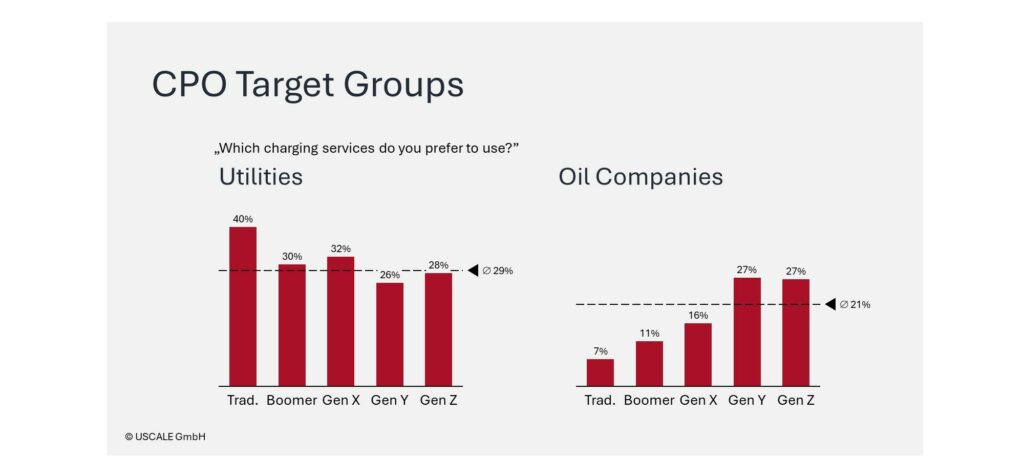

Target group dynamics: Who appeals to whom?

With the entry of new EV adopter segments, new user groups are entering the market. The study shows the consequences this has for providers’ market shares. One example is age differences:

- Energy suppliers are attractive to all age groups (but especially to traditionalists). At first glance, this is a good thing.

- Mineral oil suppliers, on the other hand, are increasingly attracting younger EV drivers – presumably due to their familiar brand world and strong physical presence along the roads. With the adoption of EVs, especially among younger target groups, they are gaining market share.

For CPOs and eMSPs, this means that

A clear target group strategy is essential. Providers need to know who they want to address and consistently align their services and communication accordingly.

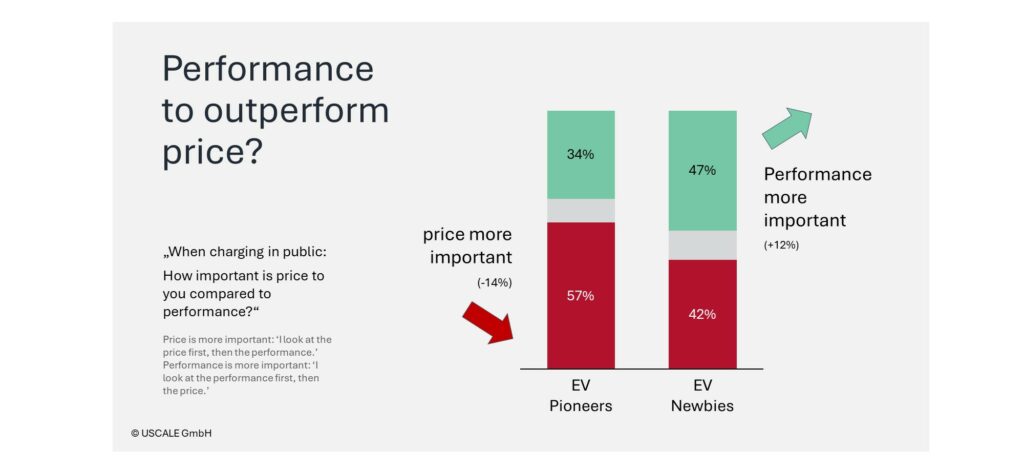

Charging prices: performance beats cost?

The charging price is often considered the biggest bone of contention in the EV sector. But the study shows that users’ attitudes are more nuanced.

- EV pioneers, who have been driving electric vehicles for some time pay more attention to price than to the performance characteristics of a charging offer.

- New EV entrants – the customer group that will be crucial for market penetration in the coming years – currently place greater emphasis on charging capacity and reliability than on the pure kWh price.

What does this mean for providers?

At first glance, price increases seem inconsequential if EV drivers are dependent on public charging services. But caution is advised: only 4% of motorists in Germany have already switched to an EV. The switch by the remaining 96% will be significantly influenced by the price level. CPOs and eMSPs must therefore maintain a balance between profitability and market attractiveness.

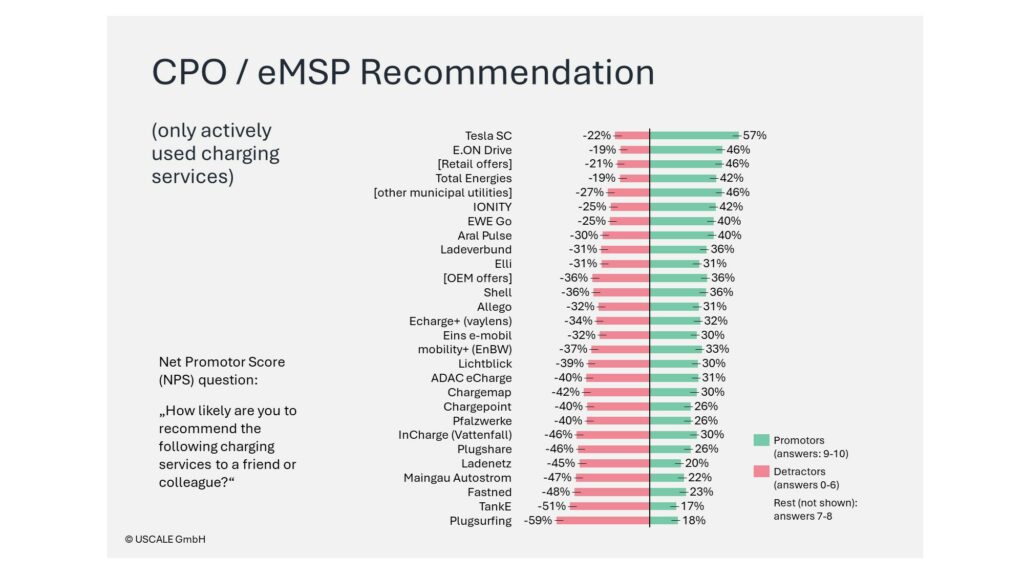

NPS: Low satisfaction among EV drivers

Satisfaction with charging services is low. This is reflected in the responses to the Net Promoter Score (NPS) question, which measures willingness to recommend:

- The average NPS value is just +1 point – a long way from genuine customer loyalty.

- Many providers have considerable room for improvement in the areas of customer experience, reliability and brand loyalty.

The message for providers is clear:

Customer satisfaction and loyalty are becoming key differentiators in the competitive landscape.

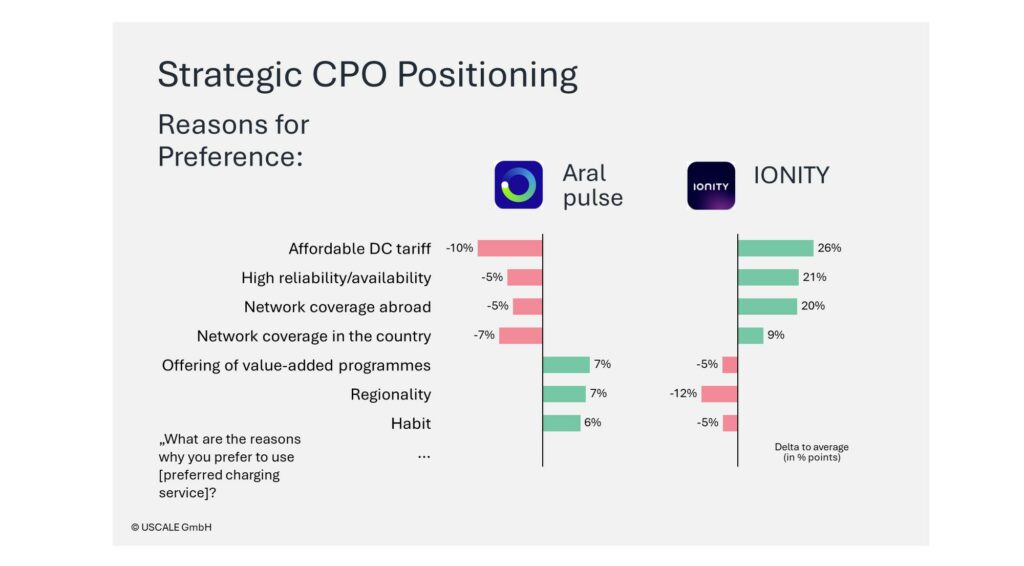

Strategic positioning of CPOs

Fragmentation is slowly decreasing: EV drivers actively use an average of three to four different charging services. But not all of them are used with the same frequency: the preferred charging service usually accounts for more than half of the revenue. All the others share the rest. This increases the pressure on providers to define a clear USP in order to prevail.

The example in the image shows selected reasons for using the two providers IONITY and Aral pulse. From the customer’s point of view, the two providers are clearly positioned – in this case diametrically opposed. Whether the positioning shown is the result of a strategy is open to question here – the point is that they are positioned.

The conclusion:

Price alone is not the decisive factor, but rather perceived performance, brand profile and strategic positioning in the market.

Brand management becomes a success factor

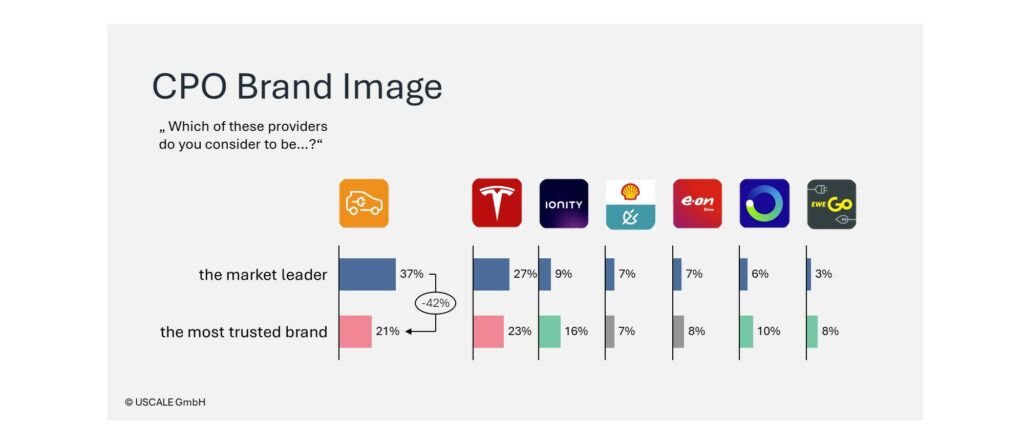

With growing network coverage of over a million charging points in Europe, the market is far from being an oligopoly like the traditional petrol station business. This leads to a lack of transparency and confusion among clients. As a result, the brand is taking on a new significance.

The example in the image illustrates brand perception in the German market:

- EnBW is clearly perceived as the market leader by EV drivers. However, trust ratings are significantly lower.

- IONITY is ahead in terms of trust – although only 9% see the brand as the leader, 16% consider IONITY to be the most trustworthy brand.

This reveals a strategic gap:

Many CPOs underestimate the importance of brand building. Until now, the focus has been on location development and operation, while brand management often takes a back seat. Yet, brand image is increasingly determining user preferences and loyalty.

About the CPO / eMSP Charging Services Study 2025

The USCALE Charging Services Study 2025 reveals the strengths, weaknesses and opportunities of the industry – from market shares to the influence of performance features and charging prices on take-up rates to brand perception. For CPOs and eMSPs, the study provides a solid basis for reviewing and realigning their strategic positioning and securing competitive advantages.

Those who ask the right questions now will be well-prepared for the next phase of the market:

- How can I differentiate myself beyond price?

- How can I increase the utilisation of my charging points?

- Which target groups do I address – and how?

- How can I strengthen my brand in an increasingly saturated market?

One thing is clear:

EV charging is on the cusp of shifting from an infrastructure issue to a branding issue. Providers who actively shape this change will secure a decisive advantage.

Sources:

USCALE Charging Services Study 2025

Press release EV Charging Services Study 2025

Curious about the full results?

We support you with data, studies and insights from our representative surveys. Contact us – we can help with our multi-client studies and ad hoc studies.

Please also take a look at the overview of our multi-client charging studies!

Contact us now

What customer insights into electric cars, charging technology or charging services are you looking for? Whatever you are looking for, we look forward to exchanging ideas.

* Mandatory fields