Electric Vehicles: Quality and Performance Improve – But Not All Brands Deliver

EV Satisfaction Study 2025: Quality and Performance Improve – But Not All Brands Deliver

EV sales have stalled, largely due to persistent concerns about driving range. Yet a new survey of over 5,000 EV drivers on EV satisfaction in Germany, Austria, and Switzerland shows that electric vehicles have made notable gains in range and other key areas. However, brand performance still varies significantly.

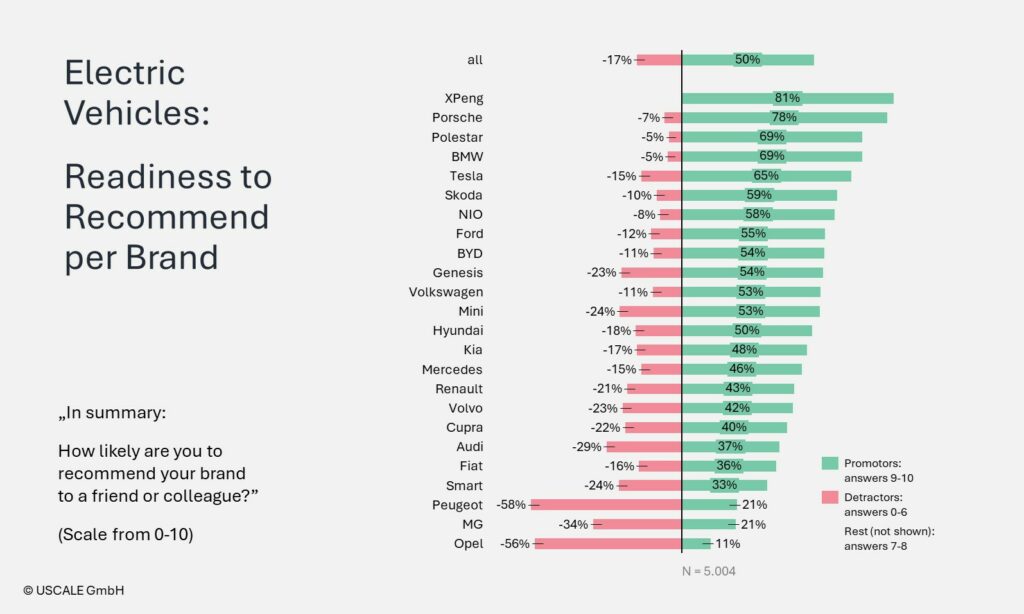

Stuttgart, 22 July 2025 – Satisfaction among electric vehicle (EV) drivers continues to grow. The latest USCALE EV Satisfaction Study 2025 reveals a significant increase in the Net Promoter Score (NPS) – a key metric indicating customer willingness to recommend – rising from 24 to 33 points (see accompanying charts).

Rising Expectations – And Rising Performance

Numerous manufacturers have either launched new models or significantly improved existing ones – and customers are taking note. This is all the more remarkable given that expectations among EV drivers have also risen over the past year. In other words, the improvements to EVs have outpaced the increase in customer expectations, leading to a noticeable rise in overall satisfaction.

Gains in Range and Charging Speed

The most notable progress has been made in terms of driving range and charging performance. According to the survey, 50% of EV owners now report a real-world summer range of over 400 kilometres – a marked improvement on last year’s figure of 38%. Charging has also improved considerably: 75% of EVs now support DC charging at 150 kW or higher, up from 61% in 2024.

Software and Connectivity Still Lagging

However, challenges remain. A striking 73% of drivers report having experienced issues when charging – such as the process failing to start, failing to stop, or unexpectedly terminating. Problems are also widespread with vehicle operation and the associated apps: 46% of drivers cite issues with the app’s performance, including limited functionality, slow response times, and poor availability. That said, even here improvements are evident: in 2024, 54% of respondents reported functional issues with their app.

Clear Differences Between Brands

The desire to recommend varies considerably between brands. Notably, Xpeng is the first Chinese manufacturer to top the rankings, replacing Tesla after many years in the lead. At the other end of the spectrum, brands from the Stellantis group continue to trail – along with MG and Smart, both of Chinese origin.

Brand Highlights

Depending on the brand, respondents see different strengths and weaknesses:

- Xpeng leads in nearly all categories, especially charging performance, range, and efficiency. The only significant weakness is in route planning.

- Porsche continues to shine for its rapid charging. The Macan, though based on a small sample size, shows notable improvement in range compared to the Taycan.

- Polestar remains a frontrunner, despite average range and high consumption. Its strengths lie in user interface, route planning, and connectivity.

- BMW impresses users with its operating concept and software, though its latest models face criticism for their range and charging speed.

- NIO earns praise for software, connectivity, and usability. While charging speed is subpar, the vehicle offers strong range despite relatively high consumption.

- Škoda has made substantial progress in almost all areas with its new Elroq, though issues persist with the app and route planning.

- Tesla loses ground due to slower charging speeds and reputational concerns linked to CEO Elon Musk’s political activities.

- BYD scores well for software and connectivity but needs major improvements in charging speed.

- Ford shows strong progress with the new Explorer, which offers excellent range and charging performance. However, app functionality is problematic.

- Volkswagen sees slight gains, especially with the new ID.7, which features better range and charging. Software and route planning, however, remain weak.

- Hyundai/Kia/Genesis delivers high charging capacity but still lacks effective route planning.

- Mercedes is praised for software and user interface, but the EQA and EQB lag in range and charging. (The new CLA is not yet included in the study.)

- Mini is improving in all categories with its new model, though older models still affect results. Range is average; charging speed is a concern.

- Renault has improved connectivity and user interface but suffers from poor charging performance.

- Volvo draws criticism for high consumption and software issues, though route planning is a strength.

- Fiat benefits from low consumption but faces major issues in connectivity and charging management.

- Cupra is average in most areas but struggles with persistent software and connectivity challenges.

- Smart fails to impress with the #1 and #3 models, with widespread issues in software, connectivity, and navigation.

- Audi has improved charging and range with the new A6/Q6 e-tron, but software and app weaknesses remain.

- MG, Peugeot and Opel continue to suffer from substantial problems in software and connectivity.

About the study

In May 2025, a total of 5,004 EV drivers of various brands and models were surveyed about their experiences with everyday use. It is part of the USCALE study portfolio for the ongoing investigation of the customer journey of EV drivers. The study was conducted for the sixth time in the German-speaking DACH region.

Quote

Dr Axel Sprenger, founder and managing director of USCALE GmbH:

“The scepticism of many people interested in EVs was justified for a long time. But now car manufacturers have taken a big leap forward and delivered. And the next generation of electric cars is in the starting blocks. So these are good times for EV buyers. For the industry, the message now is: keep at it and don’t let up!”.

More information on the study:

PRESS HANDOUT with additional charts

Further informationen on this study

List of all study content

About USCALE

USCALE is a consulting and market research company for electric mobility based in Stuttgart. USCALE’s work is based on customer insight studies covering all touchpoints of the e-mobility customer journey. With its own panel of over 10,000 EV drivers, USCALE’s studies provide a structured overview of user pain points and the potential for all providers in the electric mobility market.

contact

USCALE GmbH, Silberburgstrasse 112, D – 70176 Stuttgart, +49 711 620014-0, media@uscale.digital